What is the Probability that the hedged revenue is less than the unhedged revenue?

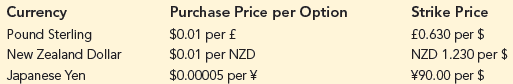

A European put option on a currency allows you to sell a unit of that currency at the specified strike price (exchange rate) at a particular point in time after the purchase of the option. For example, suppose Press Teag Worldwide (from Section 11.3) purchases a three-month European put option for a British pound with a strike price of £0.630 per U.S. dollar. Then, if the exchange rate in three months is such that it takes more than £0.630 to buy a U.S. dollar, for example, £0.650 per U.S. dollar, Press Teag will exercise the put option and sell its pound sterling at the strike price of £0.630 per U.S. dollar. However, if exchange rate in three months is such that it take less than £0.630 to buy a U.S. dollar, for example, £0.620 per U.S. dollar, Press Teag will not exercise its put option and sell its pound sterling at the market rate of £0.620 per U.S. dollar. The following table lists information on the three-month European put options on pound sterling, New Zealand dollars, and Japanese yen.

Modify the simulation model in the file Quarterly Exchange Model to compare the strategy of hedging half of the revenue in each of three foreign currencies using European put options versus the strategy of not using put options to hedge at all. What is the average difference in revenue (hedged revenue – unhedged revenue)? What is the

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You won’t have to worry about the quality and deadlines

Order Paper NowProbability that the hedged revenue is less than the unhedged revenue?

The post What is the Probability that the hedged revenue is less than the unhedged revenue? appeared first on Best Custom Essay Writing Services | EssayBureau.com.